Quick Facts

| Fact | Details |

|---|---|

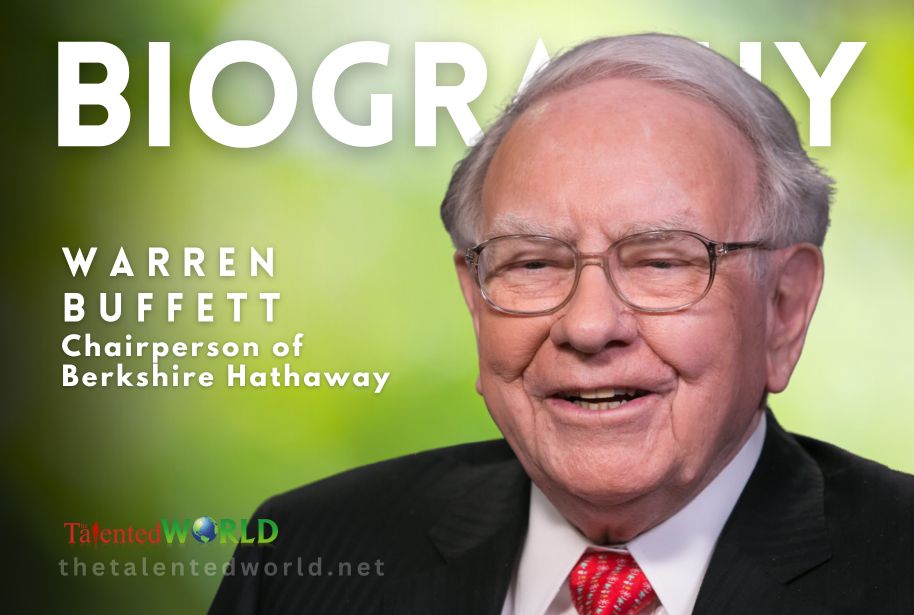

| Full Name | Warren Edward Buffett |

| Date of Birth | August 30, 1930 (age 93) |

| Place of Birth | Omaha, Nebraska, U.S. |

| Education | University of Pennsylvania; University of Nebraska–Lincoln (BS); Columbia University (MS) |

| Current Positions | Chairman and CEO of Berkshire Hathaway |

| Years Active | 1951–present |

| Key Achievements | Transforming Berkshire Hathaway; notable for value investing and frugality |

| Political Party | Democratic |

| Spouses | Susan Thompson (m. 1952; died 2004); Astrid Menks (m. 2006) |

| Children | Susan Alice, Howard Graham, Peter |

| Parents | Howard Buffett (father) |

| Relatives | Howard Warren Buffett (grandson); Doris Buffett (sister) |

| Net Worth | $139 billion (as of April 2024) |

| Philanthropy | Pledged to give away 99% of his fortune; co-founder of the Giving Pledge with Bill Gates |

| Early Ventures | Sold chewing gum, Coca-Cola, and weekly magazines; owned pinball machines in barber shops |

| Career Milestones | Founded Buffett Partnership Ltd. in 1956; acquired Berkshire Hathaway and became chairman in 1970 |

| Notable Titles | Referred to as the “Oracle” or “Sage” of Omaha |

| Website | Berkshire Hathaway |

Warren Buffett Net Worth

Warren Buffett’s net worth is approximately 134.5 billion.