Quick Facts

| Quick Facts | Details |

|---|---|

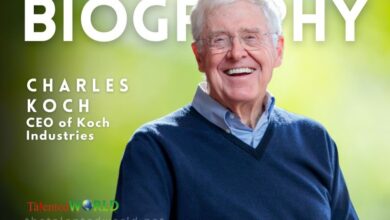

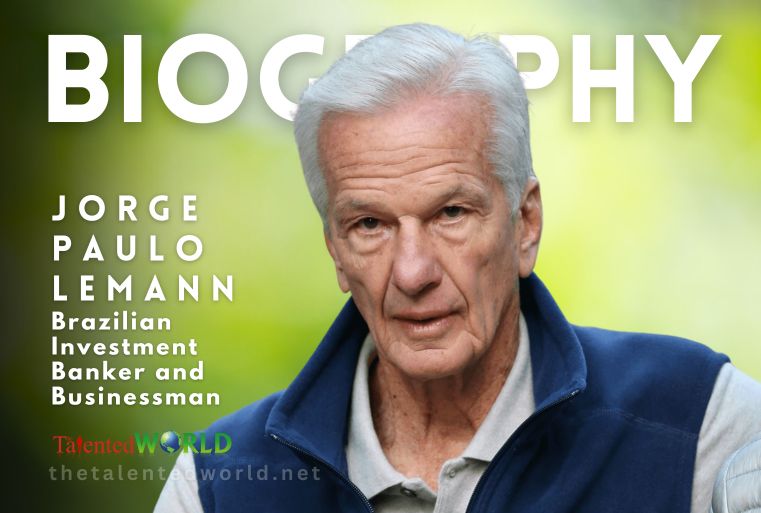

| Full Name | Jorge Paulo Lemann |

| Date of Birth | August 26, 1939 |

| Place of Birth | Rio de Janeiro, Brazil |

| Citizenship | Brazilian, Swiss |

| Education | Harvard University (BA) |

| Occupation | Businessman, Investor, Investment Banker |

| Known For | Ambev, 3G Capital |

| Spouses | – Maria Quental (m. 1966; div. 1986) |

| – Susanna Mally (m. 2005) | |

| Children | 5 |

| Website | fundacaolemann.org.br |

| Early Life | – Born to Swiss immigrant Paul Lemann and Brazilian Anna Yvette Truebner |

| – Attended American School of Rio de Janeiro | |

| – Bachelor’s in Economics from Harvard University (1960) | |

| Tennis Achievements | – Brazilian national tennis champion five times |

| – Played in the Davis Cup for Brazil and Switzerland | |

| – Competed at Wimbledon in 1962 | |

| Career Milestones | – Trainee at Credit Suisse, Geneva (1961-1962) |

| – Co-founded Banco Garantia (1971) | |

| – Helped control AB InBev as a board member | |

| – Co-founder of 3G Capital, owning brands like Burger King, Anheuser-Busch, and Heinz | |

| – Merged AmBev with Interbrew to form InBev (2004) | |

| – Acquired Anheuser-Busch to form AB InBev (2008) | |

| – 3G Capital acquired H.J. Heinz (2013) and merged Kraft Foods with Heinz (2015) | |

| Philanthropy | Founder and board member of Fundação Estudar |

| Notable Board Memberships | – Lojas Americanas S.A. |

| – Former board member of Gillette | |

| – Former member of Kraft Heinz board (until 2021) | |

| Personal Life | – Married twice, six children |

| – Resides between São Paulo, Rapperswil-Jona, and St. Louis | |

| – Survived an attempted kidnapping of his children in 1999 | |

| Public Profile | He rarely gives interviews or appears publicly |

| Net Worth | $17.2 billion |

Jorge Paulo Lemann Net Worth

Jorge Paulo Lemann net worth is approximately 17.2 billion USD.